Making the most of your fund’s growth is crucial in the ever-changing financial environment of today. With interest rates far greater than those of typical savings accounts, high-yield saving accounts (HYSAs) present an alluring option. In order to help you make wise decisions and maximize your financial future, this guide includes the top high-yield savings accounts that are easily accessible.

What are High-Yield Savings Plans?

A deposit account that provides a significantly greater Annual Percentage Yield (APY) than typical savings accounts is known as a high-yield savings account. These accounts which are typically provided by online banks with minimal overhead expenses, pass the savings on to clients in the form of higher interest rates. Important advantages of saving accounts include the following.

- Enhanced Earnings

Your money grows more quickly when the APY is higher.

- Liquidity

The ability to quickly obtain money for certain objectives or other purposes.

- Safety

The Federal Deposit Insurance Corporation (FDIC) insures the majority up to $250,000 per depositor.

Important Things to Consider

Consider the following when choosing a high-yield savings account.

- Annual Percentage Yield (APY)

Your earnings increase with APY.

- Fees

To optimize net returns, choose accounts with little or no fees.

- Minimum Balance Requirements

Verify that the necessary balance fits into your budget.

- Accessibility

Take into account features like online and mobile banking that make deposits and withdrawals simple.

- Customer Service

Your banking experience might be improved with dependable assistance.

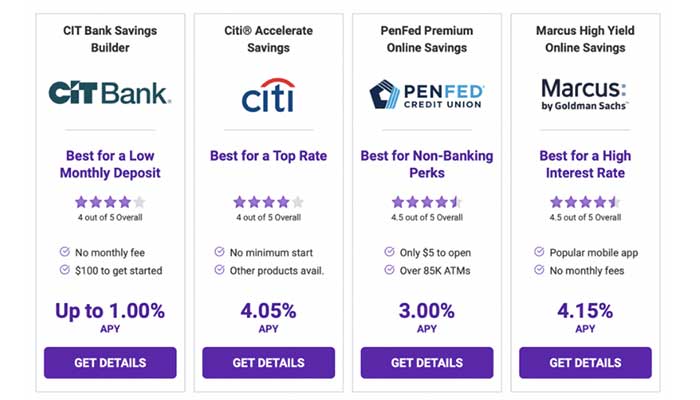

Best High-Yield Savings Accounts

Here are a few of the top high-yield savings accounts.

Marcus by Goldman Sachs High-Yield Savings Account

- The High-Yield Online Savings Accounts from Marcus by Goldman Sachs with an annual percentage yield of 5.00%.

- There are no monthly maintenance fees and there is no minimum deposit.

- An easy-to-use web interface and customer support.

Marcus is a great option for savers looking for simplicity and good returns because it provides a competitive APY with no fees.

American Express High Yield Savings Account

- 4.75% APY for the American Express High Yield Savings Account.

- There are no monthly service fees and there is no minimum deposit.

- Features include strong connectivity and mobile banking, round-the-clock customer service.

This account, which is supported by a respectable banking organization, offers a robust annual percentage yield together with outstanding customer support.

Discover Online Savings Account

- Savings account with an APY of 4.50%.

- No maintenance costs and there is no minimum deposit.

- Features include live chat assistance and round-the-clock access via mobile apps and internet banking.

For tech-savvy savers, Discover offers a smooth banking experience together with a respectable APY.

CIT Bank Savings Builder Account

- APY subject to certain conditions, up to 4.75%.

- No maintenance fees. The opening deposit is $100.

- Promotes persistent deposits with a greater annual percentage yield (APY).

Disciplined savers who can make consistent contributions are rewarded through this account.

Ally Bank Online Savings Account

- APY 4.25%.

- There are no monthly maintenance fees and there is no minimum deposit.

- Features include 24/7 customer support and extensive online and mobile banking.

A competitive Annual Percentage Yield (APY) and a variety of digital tools are combined by Ally to improve the overall banking experience.

Strategies to Maximize Your High-Yield Savings

In order to get the most out of a high-yield savings account, do the following.

- Automate Your Savings – For steady growth, set up automatic transfers.

- Comparing rates on a regular basis would help you make sure you’re getting the best Annual Percentage Yield (APY) because interest rates can change.

- Steer Clear of Unnecessary Fees – Keep an eye on account activity to maintain necessary balances and stay within transaction limitations.

- Leverage Account Features – To make saving easier, make use of resources like mobile check deposits and goal-setting capabilities.

High-Yield Savings Accounts are an effective and safe way to increase your money. You can fully benefit from high interest rates and see your savings grow by choosing an account that fits your spending patterns and financial objectives. Be proactive, knowledgeable, and disciplined to maximize the benefits of these accounts.

Leave a Reply