Thanks to the emergence of cutting-edge real estate investing apps; real estate investing has never been easier. Investors can easily purchase, sell, and manage real estate assets with the help of these apps. The right software can help you track market trends, diversify your portfolio, and optimize returns, regardless of your level of experience. The top real estate investment apps are examined in detail in this guide along with their features, advantages, and possible drawbacks.

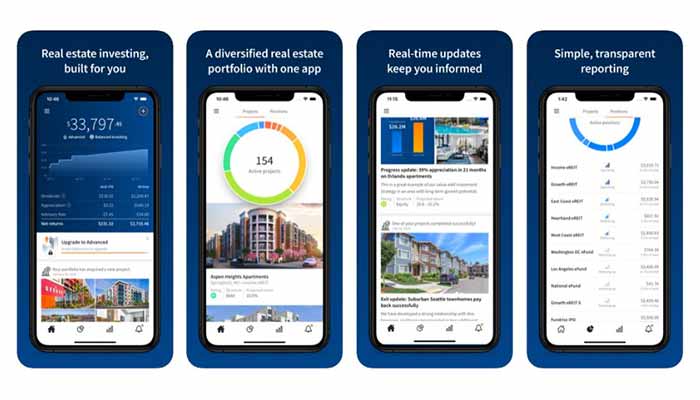

1. Fundrise – The Greatest Platform for Novice Investors

One of the most widely used apps for real estate investing is Fundrise which was created to make real estate accessible to everyone. With as little as $10, investors can participate in private real estate investments using its user-friendly platform.

Features of Fundrise

- Low minimum investment, just $10 is needed to begin investing.

- You can make a diverse portfolio, make investments in both commercial and residential real estate.

- You can create passive income. Make money from real estate appreciation and rental income.

- The auto-invest feature ensures steady portfolio growth, therefore, you can automate investments.

- Transparent fee structure. Low annual advisory fees (0.15%) and asset management fees (0.85%).

Benefits and Drawbacks

- Excellent for novices with little prerequisites.

- Robust historical returns.

- Investing without getting involved.

- Limited liquidity, early withdrawals can be problematic.

- Less control over specific investments.

2. Roofstock – Best for Single-Family Rentals

For investors wishing to buy single-family rental residences, Roofstock is the best option. For people who want physical assets, Roofstock is a great choice because it permits direct ownership of rental homes; unlike other platforms.

Features of Roofstock

- Purchase completely tenant-occupied properties, you don’t have to look for tenants.

- Get data-driven insights, detailed financial information for every property.

- Houses go through a rigorous examination process.

- A more passive investing experience through fractional ownership.

- Provides thorough financial forecasts.

Benefits and Drawbacks

- Direct possession of property.

- Access to rental assets that generate income.

- Direct tenant management isn’t necessary.

- More expensive up-front than REITs.

- Requires investors to do some research.

3. CrowdStreet – The Finest Platform for Certified Investors

Accredited investors can use the real estate crowdfunding portal CrowdStreet. It offers chances to invest in significant business ventures in a range of sectors.

Features of CrowdStreet

- Make investments in real-estate developments with significant value.

- You can select properties according to your investment objectives.

- Detailed market research and investing insights are examples of transparent due diligence.

- Since there are no middlemen, the potential returns are higher.

- Gain access to webinars and market research to hear directly from professionals in the field.

Benefits and Drawbacks

- Excellent discounts on commercial real estate.

- High returns are possible.

- Thorough analysis of investments.

- Accreditation is necessary (high income / net worth requirements).

- Hefty minimum investment at least $25K.

4. Arrived Homes – The Greatest for Passive Investors

For people who wish to invest in rental houses without becoming landlords, Arrived Homes is a great choice. As little as $100 can be used to fractionally own rental properties using the site.

Features of Arrived Homes

- Start with as little as $100.

- Fully managed properties, you don’t have to be concerned about maintenance or tenants.

- Get quarterly dividend payouts, use rental income to generate passive income.

- There are diversified investment options. You can select from a variety of cities and real estate kinds.

- The platform is easy to use, making it simple to browse and invest in real estate.

Benefits and Drawbacks

- All investors with low buy-in can access it.

- No duties related to property management.

- Equitable distribution of income.

- Restricted liquidity.

- Reduced profits in contrast to direct property ownership.

5. RealtyMogul – The Greatest for REIT Investments

A variety of investors can use RealtyMogul because it is a hybrid platform that offers both publicly traded and private REITs.

Features of RealtyMogul

- Both public and private REITs. Make investments in several kinds of real estate funds.

- You get direct investment opportunities. Individual properties are available for purchase by accredited investors.

- Access to thorough financial reports is another benefit of comprehensive reporting.

- Make steady profits by renting out your property.

- A varied investment portfolio that consists of residencies, office buildings, and other assets.

Benefits and Drawbacks

- Investors of all skill levels can profit.

- There are several alternatives for investments.

- Possibility of steady passive income.

- Greater minimum sums for private transactions.

- Accredited investors are the only ones who can make certain investments.

6. Groundfloor – Best for Short-Term Investments

Investors can finance short-term real estate loans using the peer-to-peer real-estate financing platform Groundfloor.

Features of Groundfloor

- Low minimum investment, just $10 is the starting point.

- The majority of short-term loans mature in six to twelve months.

- High Yield Potential, 7 to 12% yearly returns.

- Diversified loan options, select loans according to your level of risk tolerance.

- No need for accreditation. All investors are welcome.

Benefits and Drawbacks

- Rapid return on investment.

- High yields in contrast to conventional saving accounts.

- Non-accredited investors are welcome.

- Default risk for borrowers.

- Returns are obtained following loan maturity; there is no passive income.

Your investment strategy, risk tolerance, and financial objectives all play a role in selecting the best real-estate investing software. With minimal minimum investments and potential for passive income, Fundrise and Arrived Homes are great places for newcomers to start.

Accredited investors seeking high-end purchases might find CrowdStreet and RealtyMogul useful while those wanting direct property ownership should investigate Roofstock. If you’re looking for high-yield, short-term investments, Groundfloor is a great option.

You can easily diversify your portfolio, create passive income, and increase your wealth by using these real-estate investing applications. Choose the platform that best suits your investing approach, then, get started on the path to financial success right now.

Leave a Reply