One of the most effective financial instruments for savers, investors, and everyone else hoping to increase their money over time is compound interest. Reinvesting interest or returns that you’ve earned enables your account to grow rapidly. The finest methods for maximizing compound interest and effectively accumulating significant money will be covered in this guide.

What is Compound Interest?

The process of compound interest involves adding interest to the principal and then earning interest on the higher sum in the future. This causes a snowball effect that speeds up the growth of your account.

Difference Between Simple and Compound Interest?

Compound interest is computed on both the principal and the accrued interest, in contrast to simple interest which is computed just on the principal.

Best Strategies to Grow Your Account With Compound Interest

1. Get Started Early and Maintain Consistency

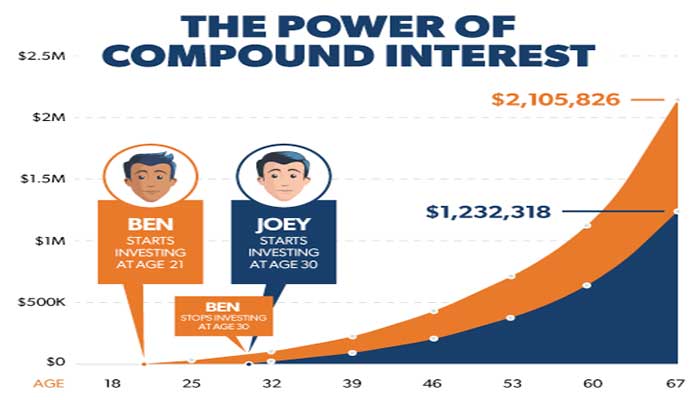

Compound interest has more time to work in your favor if your start early. Over decades, even little contributions can have a big impact. Take the example of two investors, for instance.

- At age 25, investor A begins investing $200 a month and at 35, he stops.

- Investor B begins investing $200 a month at age 35 and keeps doing so until age 65.

Even if investor A only made contributions for ten years, the extra period for compound growth will increase his wealth by retirement.

2. Gradually Increase Your Contributions

To optimize compounding, raise your payments as your income rises. Implement the following tactics.

- Increase in Annual Contributions – Increase your annual savings rate by 1% to 2%.

- Invest bonuses, tax returns, or unforeseen income inflows rather than spending them. This is known as windfall investing.

3. Select Investments With High Yields

Compounding benefits vary throughout investment tenure. Think about the following choices.

- Investments in the stock market have historically yielded larger returns than savings accounts or bonds.

- Compound gains are enhanced by Dividend Reinvestment Plans (DRIPs) which automatically reinvest payouts.

- ETFs and Index Funds – These provide long-term growth potential and wide market exposure at a lower risk.

- Real Estate Investments – The compounding impact of rental income can be achieved by reinvesting it in more properties.

4. Utilize Accounts that Offer Tax Benefits

By reducing tax obligations, tax-advantaged accounts can increase the power of compounding.

- Employer-sponsored retirement plans with tax-deferred growth are known as 401 (k) or 403 (b) plans.

- Traditional or Roth IRAs – Provide tax advantages that improve compounding.

- Health Savings Accounts (HSAs) – If utilized for approved medical costs, they can grow tax-free.

5. Invest Your Profits Again

Reinvesting your profits instead of taking them out is one of the best strategies to speed up compound growth. This pertains to the following.

- Dividend on stocks.

- Interest received from saving accounts and bonds.

- Real-Estate rental income.

6. Compounding Frequency Optimization

Your money increases more quickly the more often interest is compounded. Select assets or accounts that offer the below mentioned things.

- Daily compounding (optimal choice).

- Monthly compounding is preferable to annual compounding.

- Compounding on a quarterly or annual basis (less efficient but still advantageous).

7. Lower Charges and Costs

The advantages of compounding might be diminished by excessive expenses. Take action to reduce expenses.

- Pick inexpensive ETFs and index funds.

- Steer clear of exorbitant trading fees.

- Choose investment platforms with modest ratios of expenses.

- Reduce fees by negotiating with financial advisors.

8. Set Up Investment Automation

Consistency and discipline are ensured when you automate your investments. You can do the following things.

- Automatic transfers from checking to investment or saving accounts.

- Establishing automatic deposits into brokerage, IRA, or 401 (k) accounts.

- Using robo-advisors to manage your portfolio in an automated and efficient manner.

9. Make Use of Dollar-Cost Averaging Power (CDA)

By investing a set sum at regular intervals, dollar-cost averaging lessens the influence of market volatility and delivers long-term compound growth.

10. Maintain Your Long-Term Investments

A key component of compound interest is time. Don’t try to time the market or make needless withdrawals. Investing for long-term enables you to achieve the following.

- Profit from market recovery.

- Make the most of exponential growth.

- Steer clear of temporary capital gain taxes.

Compound Interest’s Effects Over Time

Use the following example.

- Investor 1 invests $5,000 at an 8% annual return between the ages of 25 and 65.

- At age 35, investor 2 makes the same initial investment and receives the same rate of return.

Because of the extra 10 years of compounding, investor 1 would have substantially more wealth by the time he would be 65.

Common Mistakes to Avoid While Compounding

- Too long of a wait to begin – Investments that are postponed lose out on years of compound interest.

- Ignoring debt with high interest – Pay off debt with high interest before concentrating on assets.

- Ignoring fees – Exorbitant fees hinder compounding growth and lower rewards.

- Making an early withdrawal – Long-term advantages are diminished when withdrawals interrupt compound development.

Using compound interest to your advantage is a game-changer for account growth. You can eventually attain exponential growth by starting early, making prudent investments, reinvesting profits, and cutting expenses. Put these tactics into practice right now, maintain consistency, and see your wealth grow naturally.

Leave a Reply